Pound Sterling declines on rising UK fiscal worries, Fed Daly’s speech eyed

The Pound Sterling (GBP) tumbles against its major peers on Friday as long-dated United Kingdom (UK) gilt yields gain sharply amid soaring public sector borrowings in August. 30-year UK gilt yields jump over 1% to near 5.50%.

The data showed that Public sector net borrowing hit £18 billion, the highest for the month in five years. Economists expected government borrowing to come in significantly lower at £12.8 billion. Read more…

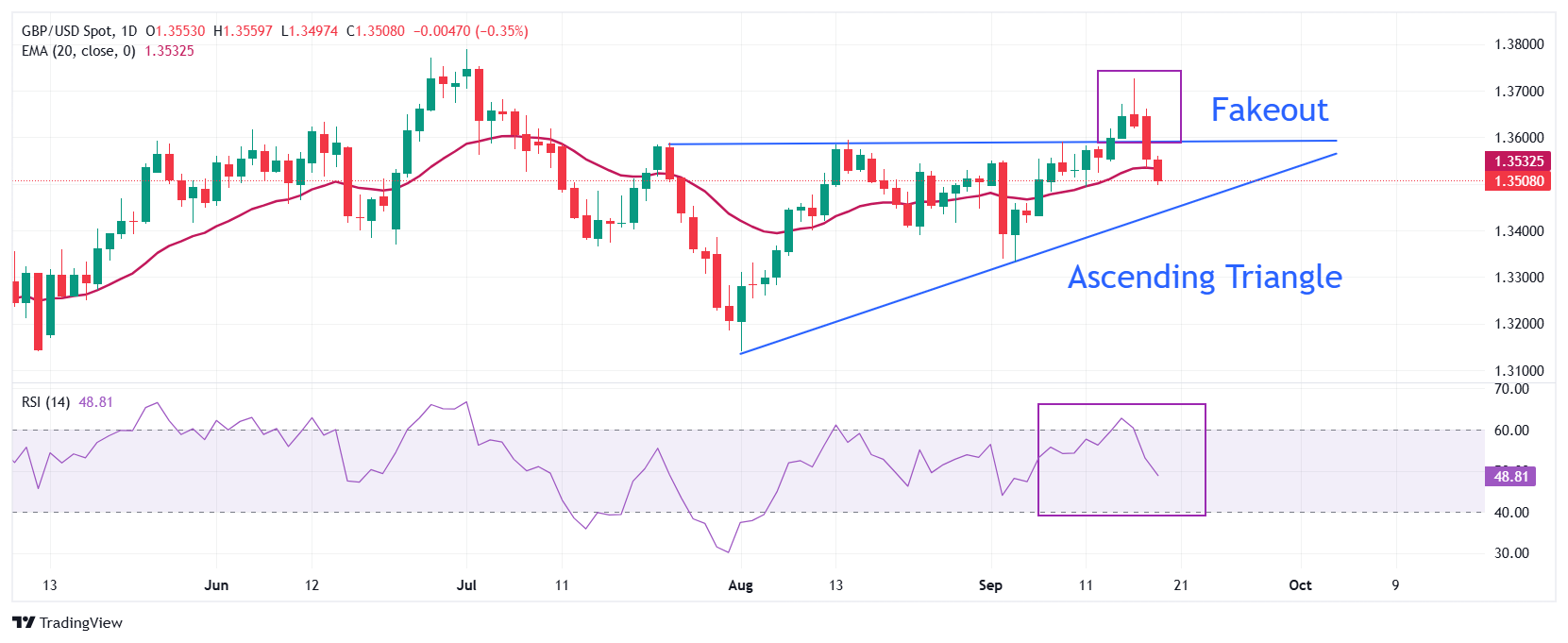

GBP/USD Price Forecast: Seems vulnerable amid BoE’s dovish pause, firmer USD

The GBP/USD pair prolongs this week’s retracement slide from its highest since early July for the third straight day and slides below the 1.3500 psychological mark, or a two-week trough during the early European session on Friday. The US Dollar (USD) sticks to its post-FOMC strong recovery gains from a three-and-a-half-year low. Furthermore, the Bank of England’s (BoE) dovish outlook contributes to the British Pound’s (GBP) underperformance and exerts additional pressure on the currency pair.

A hawkish assessment of Federal Reserve (Fed) Chair Jerome Powell’s remarks on Wednesday remains supportive of the USD move up for the third straight day. The US central bank, as was anticipated, lowered borrowing costs by 25 basis points (bps) for the first time since December 2024 and indicated that more interest rate cuts would follow by the year-end amid the softening labor market. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.