UK advertising watchdog bans Coinbase ads as ‘irresponsible’

The ASA banned Coinbase adverts concluding they imply crypto could ease the country’s cost-of-living crisis.

Jan 28, 2026, 1:45 p.m.

The U.K.’s Advertising Standards Authority (ASA) on Wednesday banned a number of crypto exchange Coinbase’s (COIN) ads, saying they suggested investing in crypto could help viewers escape financial problems and misrepresented the risks of crypto investing.

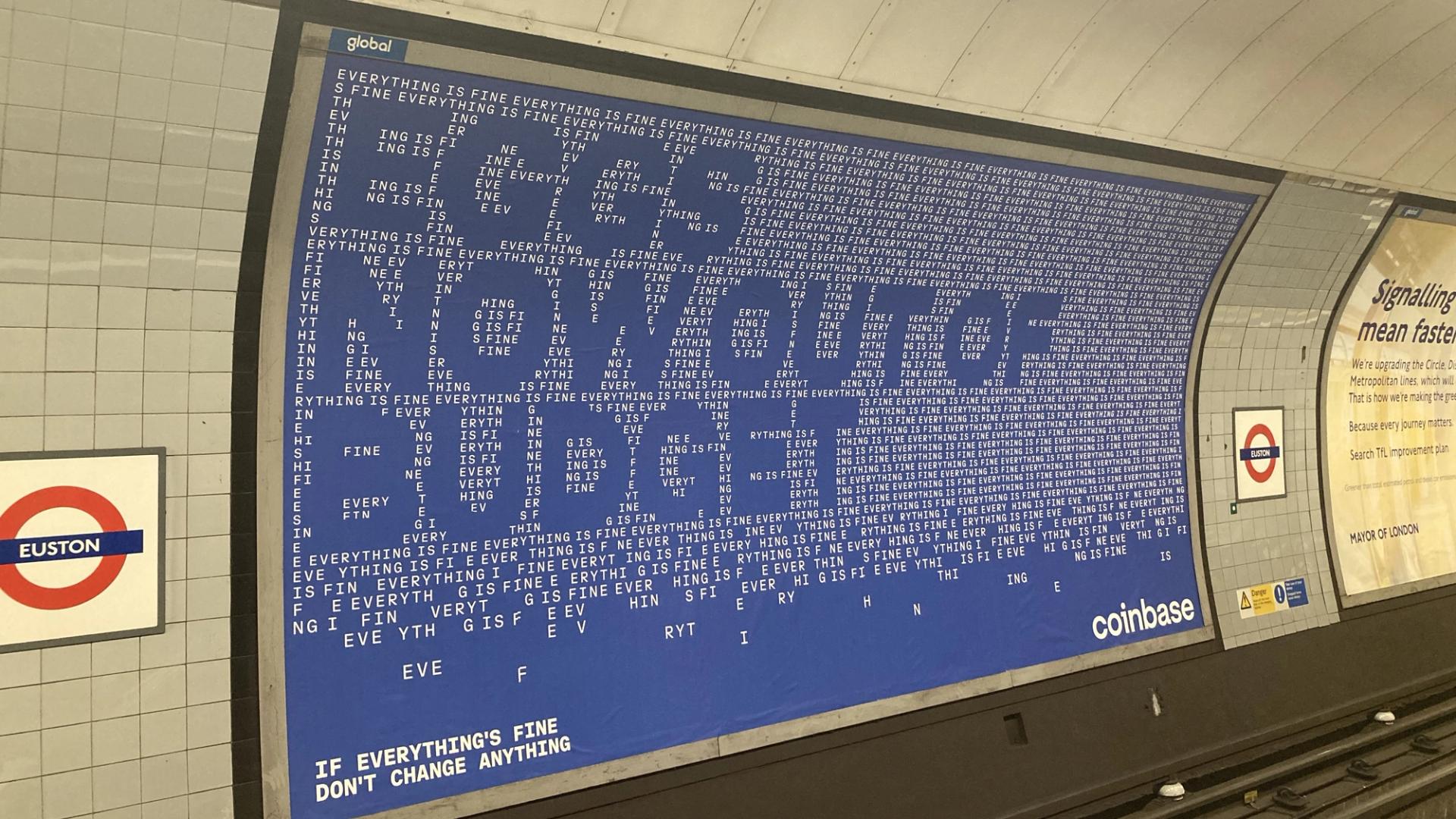

The ads, which were displayed in August, highlighted the financial pressures affecting some U.K. households and carried the phrase “If everything’s fine, don’t change anything” with Coinbase’s logo.

“By presenting the country as failing in areas such as the cost of living and home ownership, the ads implied to consumers that they should make a financial change,” the ASA said in its ruling. “Because the ads implied that cryptocurrency could be an alternative to the prevalent financial concerns associated with the cost of living, we considered that they trivialised the risks associated with cryptocurrency investment.”

The ruling highlights how U.K regulators are monitoring messaging they believe downplays investment risks or presents digital assets as a solution to economic hardship. The Financial Conduct Authority (FCA) recently initiated a set of consultations on new rules for the industry to be implemented by October 2027.

The adverts from the U.S.-based company include a satirical two-minute video showing people cheeringly singing “everything is just fine, everything is grand” as their home falls into a state of disrepair and suffers a power cut, while outside Britons gleefully dance through streets littered with rats and piles of overflowing bin bags.

“While we respect the ASA’s decision, we fundamentally disagree with the characterisation of a campaign that critically reflects widely reported economic conditions as socially irresponsible,” a Coinbase spokesperson told CoinDesk.

The advertising watchdog told Coinbase the ads must not appear again in that same form and to ensure that future ads did not misrepresent the risks of crypto or imply they are a solution to financial concerns.

Coinbase’s spokesperson said they were not intended “to offer simplistic solutions or minimise risk.”

Coinbase believes that “while digital assets are not a panacea, their responsible adoption can play a constructive role in a more efficient and freer financial system,” they said. “Coinbase remains committed to authentic, thought-provoking communication and to operating responsibly within the U.K.’s regulatory framework.”

More For You

Pudgy Penguins: A New Blueprint for Tokenized Culture

Pudgy Penguins is building a multi-vertical consumer IP platform — combining phygital products, games, NFTs and PENGU to monetize culture at scale.

What to know:

Pudgy Penguins is emerging as one of the strongest NFT-native brands of this cycle, shifting from speculative “digital luxury goods” into a multi-vertical consumer IP platform. Its strategy is to acquire users through mainstream channels first; toys, retail partnerships and viral media, then onboard them into Web3 through games, NFTs and the PENGU token.

The ecosystem now spans phygital products (> $13M retail sales and >1M units sold), games and experiences (Pudgy Party surpassed 500k downloads in two weeks), and a widely distributed token (airdropped to 6M+ wallets). While the market is currently pricing Pudgy at a premium relative to traditional IP peers, sustained success depends on execution across retail expansion, gaming adoption and deeper token utility.

More For You

Coinbase opposition won’t stymie U.S. crypto market structure bill, HSBC says

The bank argued that legislative momentum remains strong as industry heavyweights prioritize long-term regulatory certainty over unpredictable enforcement.

What to know:

- HSBC suggested Coinbase may prefer a compromise bill over no legislation at all.

- With Ripple and Coinbase funding the Fairshake PAC, the report highlighted that significant capital is being deployed to ensure Congressional candidates pass clear statutory rules.

- The bank envisions a potential path where the Senate Agriculture Committee’s bill passes first, granting the CFTC authority over spot commodities even if SEC-related issues remain unresolved.