After the pandemic-era surge in news publishers’ subscribers, year-over-year gains are harder to come by, pushing publishers to prioritize retention, moving subscribers to higher-priced tiers and bundles, and product expansion.

Digiday analyzed the subscription and paid reader revenue trends among major news publishers that have publicly shared these numbers, including The New York Times, The Wall Street Journal, Bloomberg Media, The Guardian and Daily Mail.

For a bunch, including The New York Times and The Wall Street Journal, growth isn’t just continuing, it’s speeding up, and likewise so is The Guardian’s paid reader contribution model. Meanwhile, Bloomberg’s subscription business shows signs of normalization after a 2024 spike, and Daily Mail is still ramping up its relatively new subscription business, which launched in 2024 in the U.K. and expanded to the U.S. and Canada in February 2025.

Rather than undercutting prices to chase growth, many are leaning into higher-value positioning and introductory offers designed to convert (and keep) paying readers. Digiday’s third annual Subscription Index found that publishers increased subscription prices by 5 percent year over year in 2025, based on a cohort of 14 publishers. (Bloomberg increased its annual subscription pricing by an eye-opening 33 percent year over year, up from $299 annually in 2024 to $399 in 2025).

“Total digital-only ARPU [average revenue per user] grew year over year to $9.72 as we stepped up subscribers from promotional to higher prices and raised prices on certain tenured subscribers,” New York Times CFO Will Bardeen said in a Feb. 4 earnings call. The Times increased the price of its bundle from $25 to $30 last year.

With traffic from search and social more volatile, subscriptions are being positioned as the stabilizing core of some news publishers’ businesses. Subscription and membership remain the biggest revenue focus (76 percent) for publishers, ahead of both display (68 percent) and native advertising (64 percent), according to Reuters Institute’s recent report on journalism trends in 2026.

Digiday has compiled four graphs illustrating the current state of subscriptions among these five news publishers:

Subscriptions continue to grow among large news publishers

As the graph below shows, subscriptions continue to grow despite industry-wide pressure on publishers’ traffic.

The backbone of this growth is packaging up other verticals, newsletters and premium briefings to raise average revenue per user and reduce churn. Execs at The New York Times frequently cite bundling its verticals like Games and Cooking into its higher-priced subscription offering — and focusing on strategies that push people to step up their subscriptions to these bundles — as key to its subscriber growth. Bloomberg has added subscriber-only newsletters and videos as added value to its paid offering.

The New York Times’s CEO Meredith Kopit Levien said last year that at least 50 percent of its subscribers are paying for a bundled subscription or for multiple product subscriptions, “which is important because those subscribers engage more, stay longer and pay more over time.” The New York Times began offering a family subscription last September, allowing up to four people to join one plan to get access to news and non-news products. It costs $5 more than The Times’ all-access subscription.

The Guardian doesn’t have a paywall and instead focuses on engaging readers and raising money around specific news moments and franchises. It began doing so roughly 10 years ago — in the U.S., most of The Guardian’s revenue now comes from reader funding.

Annually, The Guardian reports its digital recurring supporters, which include paid memberships, subscriptions and regular contributions. The publisher offers monthly and annual subscriptions across three tiers, and readers can also make one-time donations.

But this growth among large publishers with robust subscription businesses isn’t representative of the vast majority of publishers with subscriptions, according to an analysis by digital consulting practice Mather Economics, which tracks hundreds of news organizations. In fact, the gap is widening between them.

Large publishers have the resources to broaden their product offerings and monetize demand more effectively, creating daily habit and reducing their reliance on the news cycle, leading to healthier subscription businesses, said Mather Economics’s Luke Magerko, director of strategic consulting, and Peter Doucette, senior managing director of strategy. Smaller publishers are facing increasing pressure from platform shifts and changing audience behavior, they added.

The median digital publisher has seen flat subscriber volume. But of the top 10 percent of publishers with subscription businesses, digital subscriber volume has grown by 77 percent over the same period, according to Mather Economic’s analysis.

Median publishers have increased digital subscription revenue by about 35 percent, while the top 10 percent has grown subscription revenue by 120 percent, according to Mather Economic’s analysis.

Declining search referrals don’t help — and even though Google Discover may be driving more readership to publishers’ stories there, audiences coming from search convert to paid subscriptions at roughly three times the rate of those arriving through Discover, Magerko and Doucette said.

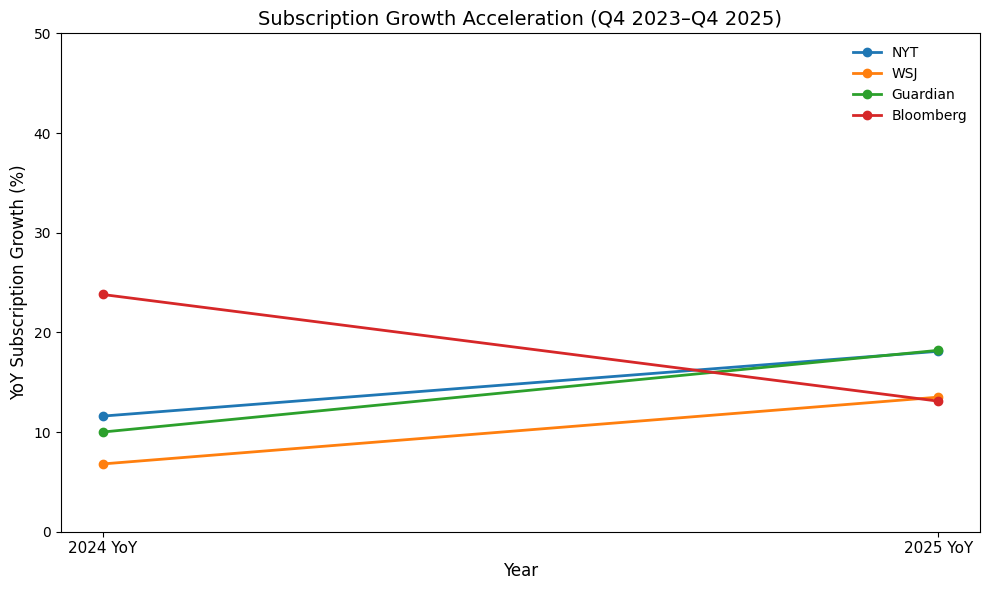

The rate of subscriber growth is also accelerating

Not only is the number of subscribers growing, but the rate of growth is accelerating year-over-year since 2023 for The New York Times, The Wall Street Journal, and the Guardian, as the above table shows, based on Digiday’s analysis. Growth rates expanded by 6 to 8 percentage points.

The Guardian recorded the strongest subscription growth acceleration among the legacy publishers, with a jump of 8.2 percentage points. The New York Times’growth accelerated 6.5 percentage points from 2023 to 2025. The Wall Street Journal posted a similar trajectory, with an acceleration of 6.7 percentage points.

However, Bloomberg’s subscription growth slowed. Year-over-year growth declined from 23.8% in 2024 to 13.1% in 2025, a decrease of 10.7 percentage points. While still delivering double-digit growth, the trajectory reflects normalization following a particularly strong 2024.

In 2025, Bloomberg changed the way it calculated its subscriber base to focus on active and activated subscribers, rather than adding in the total number of enterprise subscription access, according to a company spokesperson. They said this better reflects people engaging with Bloomberg through its subscription.

Publishers squeeze more revenue out of readers

As expected, subscriber growth also translates to an increase in subscription revenue year-over year, as the below table shows. (It should be noted that News Corp doesn’t break out subscription revenue for The Wall Street Journal in its earnings, but does provide those numbers for Dow Jones — which includes The Wall Street Journal, Barron’s and MarketWatch — and combines circulation and subscription revenue.)

Digiday’s Subscription Index found that on a weighted average basis, subscriptions as a portion of publishers’ revenue continued to increase year over year in 2025 — climbing from a weighted average score of 1.57 in 2023 to 2.60 in 2025 — indicating that publishers’ subscription revenue has increased since 2023.

Subscription retention has also improved for publishers like News Corp. News Corp CEO Robert Thomson said during the company’s latest earnings call on Feb. 5 that there was “a significant increase” in enterprise subscriptions for Dow Jones, which “tend to be large deals with lower churn and significantly lower marketing costs.”

News Corp CFO Lavanya Chandrashekar noted in the call that enterprise and corporate subscriptions have “very high retention rates.”

She added that the company raised prices for The Wall Street Journal’s digital subscription for new sign-ons, and continued to increase prices for a portion of its tenured subscribers, which help to drive up ARPU.

“We are also implementing changes to our promotional offerings, including shorter duration offers and higher introductory pricing, which we expect will have a positive impact on ARPU,” Chandrashekar said.

Yet publishers still feeling the traffic pressure

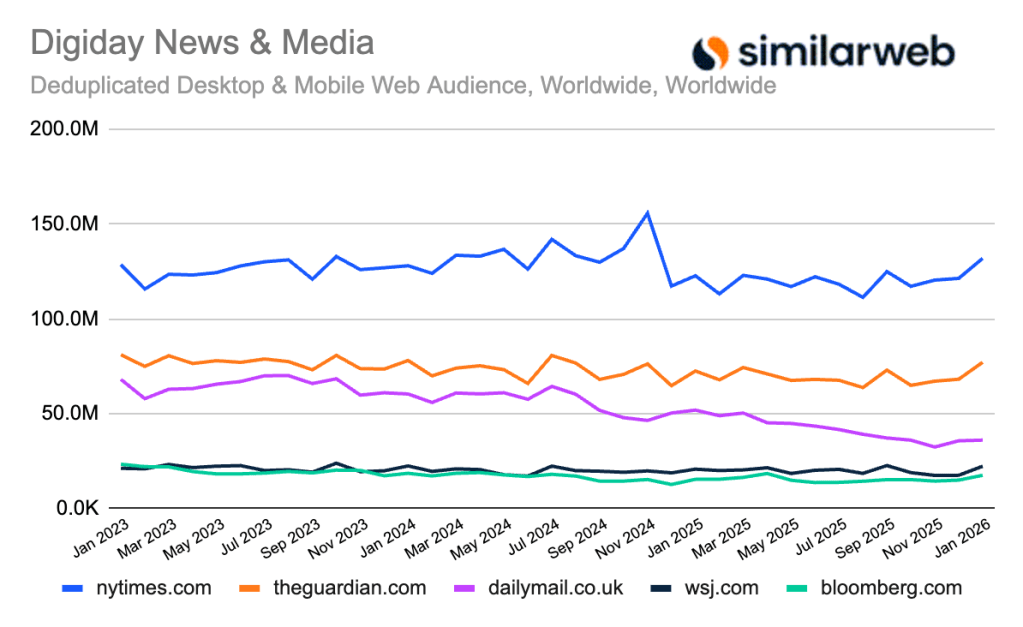

These news publishers are continuing to expand their subscription businesses despite broad traffic erosion tied to search shifts and AI-driven discovery changes.

Similarweb data shows year-over-year traffic trends were positive for all the publishers analyzed in this story, other than Daily Mail, which saw traffic drop 30.5 percent. (The data is based on a deduplicated audience number that factors out the overlap between unique desktop and unique mobile web visitors, according to David Carr, senior insights manager at data analytics company Similarweb.) Publishers with paywalls have been less susceptible to referral traffic erosion, and the Daily Mail’s paywall is less restrictive than the others.

The New York Times grew traffic by 7.5 percent year over year in January, The Guardian by 6.4 percent year over year, The Wall Street Journal by 7.4 percent year over year and Bloomberg by 13.8 percent year over year.

However, when looking at the trailing 12 months figure (which smooths out monthly ups and downs of traffic changes), the picture is less positive. The New York Times saw traffic decline by 9.4 percent over the trailing 12 months, The Guardian by 4.3 percent, The Daily Mail by 26.6 percent and Bloomberg by 6.2 percent over the trailing 12 months. Only The Wall Street Journal grew traffic when looking at this figure, by 0.9 percent.